B2B Merchant Processing

Specializing in Business-to-Business and Business-to-Government Payment Solutions which allow you to process Purchasing, Corporate, Business and GSA Credit Cards and Large Ticket Sales for the lowest available processing and interchange fees especially created by VISA, MasterCard, Discover and American Express for B2B and B2G merchants, suppliers and customers.

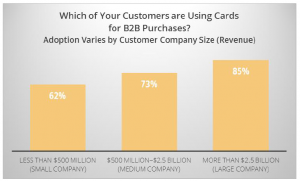

Commercial cards usage in the Business-to-Business (B2B) & Business-to-Government (B2G) payments market is growing.

Look at the following trends:

Do You Currently Accept Payments From Other Businesses or Government Agencies Without Adding Level 2 and 3 Data?

If you do, you’re likely paying significantly higher processing rates than you should. In most cases, adding Level III (L3) Data through our specialized virtual terminals will reduce the Interchange Rates that you pay for processing Business-to-Business (B2B) and Business-to Government (B2G) transactions. Because the Interchange reduction is a percentage, your savings increase with the size of your transactions. (Example: standard Level 1 Interchange 2.95% reduced to Level 3 Interchange of 1.80% = 1.15% which is a savings of 39% on your Interchange Rate).

What is the Effective Rate and Why is it Important?

We understand that as a merchant, you are always looking for ways to save money. The first thing we do when analyzing your processing statement is to calculate the “Effective Rate” (AKA “Real Rate”) you are paying with your current processor. To accurately determine your cost for credit card processing, you must look beyond your Qualified Discount Rate you are paying, and take into account ALL fees paid during the month in relation to the total dollar volume processed. This is the most accurate measure of what you are paying for your service since it expresses, by percentage, how much you are paying in fees for every hundred dollars you process.

For Example, I your total monthly processing fees were $345 and you processed $10,000 that month, your effective rate would be $345/$10,000 = 3.45% which means you are paying $3.45 for every $100 you process in credit cards. Ideally you would want the lowest effective rate possible without sacrificing performance and quality of service and support. This calculation gives you an accurate and comprehensive measure of your processing costs as a percentage of sales. Once you have your effective rate, you can accurately know what you are paying your present processor to process your credit card sales. Knowing your effective rate will give you an advantage in making the most accurate and informed financial decision for your business.

You an easily calculate your effective rate by entering in the total processing costs for the month and total credit card sales processed for that month in the form below.

How Do I Know if My Effective Rate is Too High?

If your effective rate. calculated above. falls within the range of 1.50% and 2.50%, then consider yourself fortunate because your pricing is fair and competitive. Its a good idea to get a statement analysis to see if there are any savings to be gained by switching to B2B Merchant Processing. Additional reasons to switch other than lower processing fees include taking advantage of the many features of our virtual terminals, next business day 24 hour funding, and B2B Merchant Processing’s excellent service and support.

If your effective rate. calculated above. falls within the range of 2.50% and 2.99%, then you are paying too much and should get a statement analysis to see how much you can save in a side-by-side comparison and switch to B2B Merchant Processing to take advantage of the special B2B Level 3 Interchange rates. Additional reasons can include taking advantage of the many features and benefits of using our virtual terminals, next business day 24 hour funding and B2B Merchant Processing’s excellent service and support.

If your effective rate. calculated above. is 3.00 or higher, then you are getting overcharged significantly and should get a statement analysis to see how much you can save in a side-by-side comparison and switch to B2B Merchant Processing to take advantage of the special B2B Level 3 Interchange rates. Additional reasons can include taking advantage of the many features and benefits of using our virtual terminals, next business day 24 hour funding and B2B Merchant Processing’s excellent service and support.

Help!! My Effective Rate Is Too High

Incredible Features: The Proof Is In The Pudding

Our Virtual Terminals have combined a powerful , full suite of professional payment tools into a single web-based application. This enables companies to turn any computer or mobile device into a point-of-sale (POS) terminal for accepting B2B and B2G payments of all types, giving you the most complete and secure business processing solution available today.

Process Business and Corporate Cards with Level 3 Data Quickly

Our specialized web-based virtual terminal identify Level 3 card transactions prior to prompting for additional information, significantly reducing excessive data entry. In addition can be set up to automatically calculate and populate data for Level 3 transactions, further maximizing your efficiency and ensure the lowest interchange rates.

Accept U.S. Government (GSA) Purchasing Cards

When accepting Government GSA purchasing cards, a company must process and pass level 3 data properly, saving a merchant 1-1.5% per transaction. Our systems will include all Level 2 data and produce simplified Level 3 within seconds through the virtual terminal or API

Visa and MasterCard Large Ticket Program Offers Large Savings

Merchants processing transactions $6980 and above can take advantage of the High Ticket Program. Rates are between 1.25-1.45% for non-GSA Purchasing Cards and for VISA GSA Purchasing cards rates range between 0.70% for $10,000-$25,000 to as low as 0.40% for transactions $500,000 and above (plus per item fee of between $35-$58.50).

Your Mobile Payment Processing Solution

We can help you accept payments on any mobile device that has an internet connection and a web browser, including smartphones, I pads and tablets. Our mobile applications are designed to adapt to devices with slower connection speeds and smaller viewing screens and at no additional cost.

Quickbooks Level 3 Processing

If your are using Quickbooks and you are selling to government and businesses using purchasing cards, our system allows you to pass Level 3 data through Quickbooks, which allows you to take advantage of much lower rates than offered through the built in processor, which is not capable of Level 3 processing.

Product Shopping Carts

We can offer you a fully integrated shopping cart that is highly flexible and can be used to sell products and services, as well as download soft products. We can brand it with your logo and color scheme, obtain shipping rates and calculate taxes. We also have integrated with numerous 3rd Party Shopping Carts.

Merge Our Payment Gateway into Your Proprietary or 3rd Party Software

Our Application Programmer’s Interface (API) is an option that allows you to integrate the power of our payment gateways into your proprietary software or many 3rd party solutions. Once integrated, your software application will be able to integrate with our systems to process real-time transactions, securely store customer payment data offsite and much more.

PCI Compliance Means Storing Customer Sensitive Data in a Secure Environment

Our systems store your customer’s information within our Payment Card Industry Data Security Standards (PCI DSS) Certified solutions. No payment information is stored locally on your computer network or premises. All payment account numbers are encrypted as soon as they enter the system and the data is stored in geographically remote and fully redundant high security data centers to ensure that it is always available to you.

Next Business Day Funding Helps You Manage Your Cash Flow

If you need the funds from your credit card transactions right away then our 24 Hour (Next Business Day) funding option is available with appropriate batch timing (3 pm ET). This allows you to receive the money deposited in your bank quickly so that you can improve your cash flow and operate your business more efficiently. You don’t have to wait 3-5 days to receive your funds.Those Are Just A Few Main Features, There Are Plenty More

Recurring Billing

Auto Billing

Installment Payments

Secure Vault Technology

Tokenization & Encryption Security

Account Updater

Multi-Channel Integration

Multiple Card Processing

Partial Void Technology

Zero Dollar Authorizations

ACH Check Processing

Invoice Presentment

Email Receipt

Multi-Merchant Reporting

Batch Upload & SFTP Data

Online Secure Bill Pay

PCI and PA_DSS Compliance

Payment Security/Fraud Detection

Business Analytics

Custom Online Reporting

MO/TO and E-Commerce

Receipt email with company logo

Customized User Access settings

Automated Batch Settlement

Secure Data Upload technology

Next Business Day Funding

Fully Optimized For Speed

American Express Offers New OptBlue Program that Lowers Your Rates and Speeds Up Funding Substantially

American Express Co. is stepping up its campaign to add merchants to its acceptance base with a program called OptBlue that gives partner merchant acquirers a greater role than they had with an older program called OnePoint. With OptBlue, the acquirer owns the relationship, services the account, takes the credit and chargeback risk, and sets pricing based on wholesale rates provided by AmEx. The Interchange Rates will now be based on transaction size and industry type, with B2B having they lowest rates of any industry category and much more competitive with VISA, MasterCard and Discover. As with OnePoint, an OptBlue merchant receives a consolidated statement showing activity on all the card brands it accepts, instead of getting a separate statement from American Express. The funding will be deposited together with VISA, MasterCard and Discover which is usually 1-2 business days, instead of 3 business days and a separate deposit. Your American Express transactions and deposit information will be on your merchant processing statement, instead of receiving a separate statement. OptBlue is for merchants that do $1 million or less in annual AmEx volume, larger accounts may still have a direct relationship with American Express. B2B Merchant Processing has this program available right now so that you can take advantage of the lower rates and quicker funding, along with a consolidated statement.

Easy to Get Started with No Upfront Costs: We Can Have You Processing Level 3 in 2 Days

It is easy to get started saving time and money with B2B Merchant Processing with no application, start up or annual fees. Our expert Payment Consultants will ask in-depth questions about your business, helping you choose the best solution for your particular needs.

- First, we study workflow to help you explore alternatives (beyond early pay discounts) for shortening days sales outstanding (DSO)

- Next, we will perform a statement analysis of your current merchant processor relationship to see what you are currently paying and show you a side-by-side comparison of what Interchange rates are available for the transactions you are currently processing, which will show you the savings available when you are set up with the proper classification and using one of B2B Merchant Processing state of the art processing solutions.

- We will follow-up by looking at your transactions to see that you are receiving the lowest rates possible for B2B and B2G transactions. Whether you sale in-person, by phone or over the Internet, we keep up with changing Industry Trends and determine how any changes might impact you.

- B2B Merchant Processing involves all necessary departments in education and training to maximize the benefits of card acceptance using the Virtual Terminal Technology and/or other integrated solutions available. Our easy-to-use solutions will be quickly grasped by your team and 24/7 help is available by phone or email.

Want to Find Out More Information?

Why Your Customers Want to Pay with a Credit Card

Ease – for customers, card payments mean faster procurement of goods/services and elimination of tedious and costly processes like invoice processing, check creation, mailing and postage. This means an efficient purchase-to-pay (P2P) process that delivers cost savings.

Staffing – the streamlined P2P process eliminates the need for the procurement and accounts payable departments to be involved with every purchase. These staff hours can be reduced or redirected to value-added activities.

Rebate – Customers are also motivated to pay via card to increase the potential for rebate from their card issuer. Industry trends indicate that many customers are willing to forego early payment discounts for card acceptance. Capture this in your payment terms.

Data – B2B card payments can offer easy access to transaction data that supports auditing efforts, cardholder reconciliation of transactions, and proper accounting treatment. Such data also provides insight that helps with strategic sourcing/contract pricing.

Float – Your customers receive monthly statements that aggregate purchases over the billing cycle. Making one monthly payment to their issuer can give your customers cash float, extending their days payable outstanding (DPO) to help them manage working capital.

Customers Will Have Questions About Credit Card Payment:

You Will Have The Answers

The benefits of credit card acceptance are optimized when merchants and customers communicate and work together to re-engineer purchase-to-pay processes. By documenting expectations and payment terms, both parties can better manage cash flow, cost savings, and day-to-day tasks.

Q. Why is it so hard to connect with the right person at the merchant location?

A. Communicate roles at your company: Ensure the sales team, order processing and accounting personnel can quickly refer customers to the primary team member(s) trained to manage card acceptance and resolve any issues with card payments or credits.

Q. Why do I have to pay a surcharge for using my commercial card?

A. You must Quantify the Benefits of Credit Card Acceptance: Imposing a surcharge to offset other fees can backfire, sending customers to your competitors. B2B Merchant Processing’s consultants can help you maximize cost savings efficiencies in card payments. Research shows that the benefits of card acceptance can outweigh the fees.

Q. Why aren’t the merchants passing the meaningful transaction data I need for reporting and reconciliation?

A. Work with B2B Merchant Processing to Pass Level 3 Data: Our consultants can address the “win-win” of passing secure, enhanced data, cost savings for you and spend transparency for your customers. B2B Merchant Processing solutions ensure the data you pass is accurate and reflective of the line item detail in the order.

Q. Why do some merchants delay processing transactions, including credits to my Commercial Card account?

A. Commit to Timely Processing: The merchant/customer relationship works best when contact terms specify that (1) customers provide current card account information at the time of the order, (2) merchants process transactions when the order is filled, and (3) merchants promptly notify customers of any issues.

Q. How can I decrease my risk of duplicate payment when charging my card and also receiving an invoice?

A. Eliminate Redundant Documentation: With card payments, you can take a fresh look at documentation requirements, saving steps and costs. Reduce the risk of duplicate payment (and unnecessary credits) when you provide a priced packing list, for example, upon order delivery vs. an invoice.

User Reviews: We Love our Users, And They Love Us.

We are fully dedicated to our merchant base. When you use B2B Merchant Processing, there is no need to worry about 24/7 customer support. With over 1,000 merchants accounts and counting, you cannot go wrong with B2B Merchant Processing. Check out what our merchants are saying!

“WOW – This is the Best Payment Processing Solution I have ever used.”

WOW – I don’t really know what else to say. This is the Best Payment Processing Solution I have ever used. I am able to take advantage of Level 3 Interchange Rates which saves us 30-40% on our B2B customers, each salesperson can process payments at their own workstation, I can review the transactions at the end of the day and correct any omissions before settlement and I get great reporting features that can be downloaded into Excel with ease. WOW- AMAZING!”

Mark – Trucking Parts Manufacturer

B2B Merchant Processing solution was designed to support both real-time and file-based credit card transactions, so the model was a perfect fit for us. In the world of PCI compliance, B2B Merchant Processing also helped solve our most pressing PCI audit needs.

EC-Zone by 3 Delta Systems is the ideal solution to serve our multi -location processing needs. The ability to manage card transactions online and give multiple users access to card data is a tremendous value and benefit to our operations.

We are less vulnerable to processing errors and the hosted solution frees-up valuable IT time. It is also more cost-effective anddid not require any upfront licensing fees or ongoing maintenance charges.

We required a payment solution that would interface with our existing platforms. As we expand to other service areas, we are confident that B2B Merchant Processing will continue to offer the payment solutions we need to support our operations

These key payment processing centers benefit greatly from the convenient and time saving solutions. The ability to speed-up our collections is a true asset to us.